Finding long-term growth opportunities for Tech in a volatile market

- 24 March 2022 (5 min read)

- The macroeconomic environment suggests significant challenges in the short-medium-term - inflation, rising interest rates and escalating geopolitical tensions are all weighing on investor sentiment. Economists are considering the implications of higher energy prices on the cost of living and consumer purchasing power.

- More positively, the shape of the yield curve remains flat, particularly for forward markets, indicating a consensus that the peak in the rate cycle will be low with limited follow-through. Volatility should start to settle, which would benefit equities growth into 2023.

- In our view, long-term fundamentals hold up for promising opportunities and growth for investors in well-chosen technology strategies.

In investing to take advantage of multi-decade, secular trends, we focus on identifying companies with strong fundamentals exposed to significant long-term themes via a combined quantitative and qualitative approach, resulting in portfolios with a high active share, low turnover, and good diversification. We don’t chase niches or fads, nor seek to anticipate macro events with short-term trading. This is pertinent when considering how rising interest rates could impact the growth potential of equities in the immediate future.

Consider the previous rate rise cycle in the US from 2015-18; while growth stocks are expected to underperform in a rising rate environment, the technology component of the MSCI ACWI returned approximately three times the performance of the broader index during the last upward rate cycle.

It is hard to suggest that 2022 will be any less volatile than 2021, and yet the technology sector has continued to report robust growth with good levels of cash and reassuring balance sheets. Of the companies in the MSCI ACWI which have reported Q4 2021 earnings as of 24 March, 67% reported better than expected revenues, and 57% reported better than expected earnings. For the technology components of the same index, the results have been 69% and 63% respectively, demonstrating the successful growth of technology companies over the last year.

Demand for new technology from enterprises and consumers continues to support growth. The use of semiconductors proliferates in a wide variety of end markets such as the internet of things (IoT) or the automotive industry. Cloud computing and digital transformation projects are contributing to growth in IT spending. According to Gartner, worldwide IT spending growth in 2021 was 6.9% higher compared to 2020, and a further 6% growth is forecast for 2022 driven by digital acceleration as enterprises around the world look to upgrade their systems to become more efficient, retain more employees, and grow their businesses.*

Within the large cap tech space, investors have been distracted by noise from a small number of high-profile companies. Netflix, for example, has seen a slowdown in subscriber growth as the pandemic-driven surge in demand eases. Management acknowledges that the release slate for the first part of 2021 is comparatively weaker, but strengthens as the year progresses which provides reassurance that this trend is transitory. Meta (Facebook) has been negatively affected by changes in smartphone operating systems curtailing its ability to harvest user data, coupled with increased competition from the likes of TikTok amongst younger demographics. It’s important to recognise these are very specific, idiosyncratic difficulties faced by this company and is not reflective of the performance of other large cap tech companies that have mostly reported encouraging results. Apple appear to be navigating supply chain difficulties nimbly whilst simultaneously enjoying strong demand for their devices; consumers continue to purchase new technology products. Alphabet (Google) reported excellent results as advertising revenue benefits from the re-emergence of traditionally high spenders such as the travel and leisure industries, which have been more supressed during the pandemic. Amazon and Microsoft both see continued strength from their e-commerce and cloud computing offerings, whilst semiconductor businesses benefit from several trends stimulating demand, including 5G which is still in its infancy.

Digital Economy

Technology and demographics are two powerful forces driving the long-term themes of the connected consumer, and the need for businesses to adopt a digital mindset when engaging with partners, customers, and employees. Widespread adoption of technology such as smartphones allows us to be connected at all times, with the younger generations in particular having a digital-first mindset. As their consumption grows and more spending takes place online or via digital channels, we seek to capture these opportunities within four key themes:

Robotech

Our Robotech strategy is composed of four diverse sub-themes which broaden our exposure to opportunities and end markets outside of the traditional robotics companies: Industrial, Transportation, Healthcare, Technology Enablers. This gives us the freedom to look through short-term market volatility and invest in exciting, disruptive technology trends such as robotic surgery, machine vision and autonomous vehicles. This diversification allows us to manage impacts such as cost inflation – while this is a short-term headwind for industrial companies with rising input costs, semiconductor companies benefit from increased pricing power and high demand, allowing them to improve their margins.

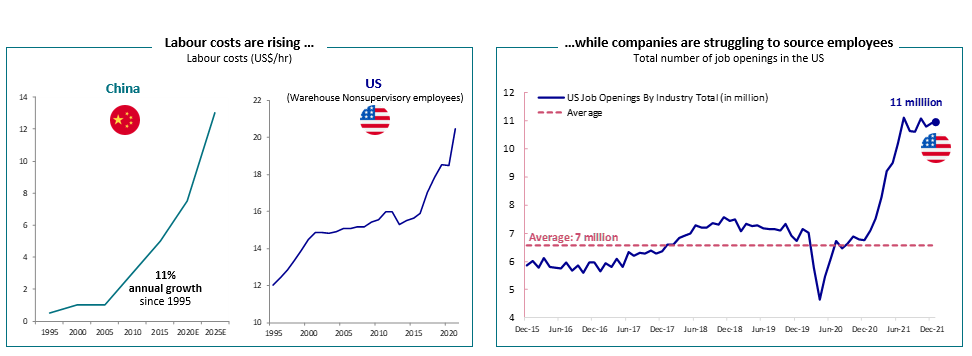

Wage inflation and labour shortage are significant concerns for many businesses but are positive growth drivers for automation as companies seek to ease these challenges. As automation becomes more sophisticated, payback periods on the capex required shorten and make investing in robotics more feasible. The steady rising cost of manufacture in China, for example, has been a major driver of automation demand in China and other emerging markets. Rapid wage inflation in US warehouses, fuelled by both a long-term shift to e-commerce coupled with a pandemic surge in demand has accelerated the shift online, and is likely to push demand for automated warehouses and logistics systems.

Source: Left Chart: BofA Merrill Lynch Thematic Investing, Robot Revolution - Global Robot & AI Primer (November 2015), Oxford Economics. Middle Chart: US Bureau of Labor Statistics, The Current Employment Statistics (CES), September 2021. Right Chart: Bloomberg as of 31/12/2021. For illustrative purposes only. Performance results of the past are no indicator for any future returns or trends. The above represents our current market views only and does not constitute investment advice.

Similarly, the supply chain issues highlighted during the pandemic are not new; a similar effect was seen during the US/ China trade war and the relocation of some manufacturing back to the US or European markets, where labour is expensive and subject to shortages. Investing in automation helps companies to mitigate and plan for future impacts upon global production.

Outlook

The connected consumer and digitalisation themes have been beneficiaries of the effects of the pandemic, with many companies seeing growth and attracting new customers. We have been mindful that some opportunities will normalise and revert to more challenging growth comparisons as its effects recede, hence we have taken profits in companies facilitating working from home capabilities or remote access systems. There remain, however, strong tailwinds as a longer-term legacy of COVID-19, and recent market volatility has shaken out stocks with attractive valuations which complement our strategies. The increasing demand for employee-facing digital HR and payroll systems, digital banking and payment solutions is unlikely to recede. Due to the length of the pandemic, the likelihood of businesses returning to pre-COVID-19 practices are slim as consumers and enterprises alike become used to easier, instant access to electronic services without any physical bottlenecks. Handling cash, for example, is likely to become increasingly rare as online payments become habitual. Companies such as FIS and Global Payments are well placed to benefit from this trend.

Similarly, we see three key areas in which robotics will grow in the coming years:

warehouse automation – automated logistics are becoming ever more crucial as companies aim to keep up with demanding online customers, insisting on rapid and reliable delivery, and this is spreading to new sectors who may not have considered automation pre-pandemic

electric vehicles (EVs) and their batteries – EVs are attracting more interest from environmentally aware consumers as prices fall and battery technology improves; capex investments need to be made now for cars produced over the next 12-24 months

importance of healthcare – governments are recognising post-pandemic that healthcare infrastructure has been under-invested in for many years and are likely to focus on how technology can boost efficiency. Many elective surgeries were postponed during the pandemic, and there is a backlog of automation-friendly surgeries such as hernia corrections which will provide steady growth opportunities.

Technology stocks are often regarded as long duration investments due in part to their research and development cycles and capex requirements, and as such can be more sensitive to a high rate environment such as the last rate cycle. This is not so relevant to the current environment, as technology companies today are increasingly cash generative with strong balance sheets, and don’t need to borrow; in fact, the most cash-rich companies may even benefit from a higher rate environment.

The connected consumer and future of automation provide attractive, long-term growth opportunities. Macro events such as rate cycles will have some effect and short periods of volatility will need to be weathered, but this is not new, as seen during previous bouts of volatility such as in 2017 following the Trump election, the 2018 US/ China trade war, and more recently the pandemic which in many ways has benefitted the long-term trajectory of the technology sector. We believe our long-term theses remain firmly intact.

*Source: Gartner Q421 IT Spending Worldwide update, 18 January 2022

Important Information

No assurance can be given that our equity strategies will be successful. Investors can lose some or all of their capital invested. Our strategies are subject to risks including, but not limited to: equity; emerging markets; global investments; investments in small and micro capitalisation universe; investments in specific sectors or asset classes specific risks, liquidity risk, credit risk, counterparty risk, legal risk, valuation risk, operational risk and risks related to the underlying assets.