EM Latin America reaction: A positive start to 2024

KEY POINTS

Growth accelerates across LatAm

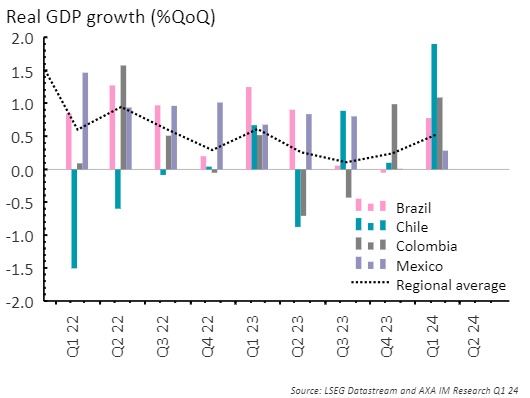

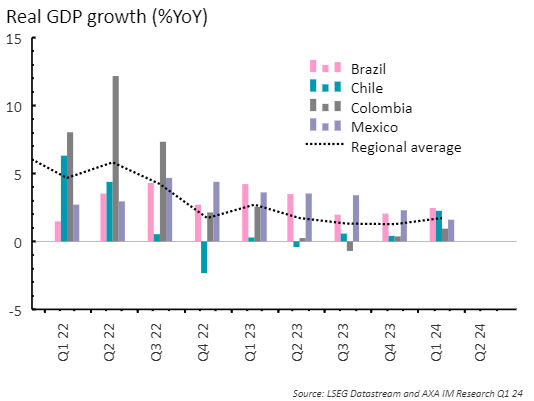

After a weak close to 2023 reflecting high interest rates and less supportive external conditions, economic growth across Latin America picked up in Q1 2024. Quarter-on-quarter economic activity accelerated in Brazil, Chile, Colombia, and Mexico, though the composition of this growth varied. In Brazil, Chile, and Mexico the boost in growth was driven by stronger domestic demand, indicating that the easing cycle in these countries is already positively impacting activity. Conversely, Colombia's growth was driven by a robust external sector, while domestic demand remained subdued due to having the highest rates in the region.

Looking ahead, Chile and Colombia are expected to maintain solid growth this year as their economies continue to recover from the macroeconomic adjustments of 2023. In contrast, Brazil and Mexico are likely to experience a moderate cooling in growth after their strong performance in 2023.

Brazil : Strong start to the year

The Brazilian economy surged in the first quarter of 2024, recovering from a sluggish performance in the second half of 2023. GDP grew by 0.8% on a seasonally adjusted quarter-on-quarter basis (q/q), rebounding from the revised 0.1% contraction in Q4 of last year. On an annual basis, GDP growth accelerated to 2.5% in Q1, up from 2.1% in the previous quarter. Both the quarterly and annual growth rates were the strongest since Q2 2023. Quarterly growth was in line with market expectations, while the annual increase surpassed them.

The quarterly upturn was supported by growth in domestic demand as it accelerated to 1.7% q/q in Q1 from 0.1% in Q4 of last year. In particular, private consumption rebounded, growing 1.5% (Q4: -0.3%), marking the best performance since Q2 2022, supported by wage growth catching up with inflation. Additionally, fixed investment growth accelerated to 4.1% in Q1, up from 0.5% in the previous quarter, likely reflecting the initial positive effects of lower interest rates. In contrast, government spending decelerated in Q1, remaining flat. The external sector was the main drag on growth, as imports grew an impressive 6.5% while exports remained stagnant. From a supply-side perspective, Q1 activity was bolstered by stronger services and agricultural and livestock sectors. However, this growth was partially offset by weak performance in the industrial sector, particularly in construction, mining, and utilities.

Going forward, we expect economic activity to benefit from several factors, including: significant fiscal stimulus, including federal transfers to low-income households, a substantial increase in the minimum wage, an improvement in the credit cycle, and robust growth in real household disposable income. However, these benefits will be tempered by a tight monetary policy, elevated household debt levels, and limited economic slack, as reflected by the unemployment rate being at its long-term trend rate (NAIRU). Given the particularly strong performance in Q1, we have revised our 2024 growth forecast up to 2.2% from 1.8%. Despite this adjustment, it still represents a deceleration from the exceptional 2.9% growth seen in 2023. For 2025, we see the economy slowing further to 1.9%.

Colombia: Economy rebounded in Q1

Real GDP growth edged up to 1.1% on a seasonally adjusted quarter-on-quarter basis in Q1, up from Q4’s 1.0% reading. Although Q1's reading fell slightly short of market expectations for a 1.2% rise, it was still the best result since Q3 2022. Annual growth also improved, reaching 0.7% from Q4’s 0.3%.

In quarterly terms, net exports were the main driver of Q1 growth, while domestic demand remained stagnant. This was due to a significant contraction in imports rather than an increase in exports. In fact, exports declined by 0.3% in Q1, while imports plunged by 5.0%, reflecting lower purchases of machinery and transport equipment. Within domestic demand, fixed investment and private consumption contributed positively to growth. Consumption benefited from a resilient labor market and rapid disinflation, growing by 1.0%, the strongest since Q4 2022. Similarly, fixed investment returned to growth after four consecutive quarters of contraction. However, these gains were offset by a contraction in inventories and subdued government spending. From an output perspective, agriculture, utilities, and recreational activities were the primary contributors to growth in Q1. Conversely, the finance sector significantly hindered growth during the same period.

Overall, our outlook on economic activity remains mostly unchanged. The economy is still weak after adjusting for the domestic demand correction following the 2022 overheating period. Looking ahead, the economy should gain momentum, with private consumption likely to be the main growth engine due to lower inflation lifting real disposable income growth and a looser monetary policy. Fixed investment should also benefit from lower rates. However, the economy will still face a series of challenges including tight external financing conditions and increased policy uncertainty due to fiscal uncertainties. Given this backdrop, growth should accelerate to 1.5% this year and further to 2.5% in 2025.

Chile: Mining sector fuels economic activity

The Chilean economy started the year on a solid footing, driven by mining sector’s robust performance, lower inflation, and a more accommodative monetary policy. Real GDP growth accelerated to 1.9% q/q in Q1, a significant improvement from the previous quarter's mild 0.1% and in line with market expectations. This marked the highest reading in over two years. Likewise, year-on-year growth reached 2.3% in Q1, up sharply from 0.4% in the preceding quarter.

Quarterly growth was driven by a robust rebound in domestic demand, which grew 1.4%, breaking a streak of eight consecutive contractions. Private consumption grew by 1.1%, the strongest since Q4 2021. Government spending rose by 4.7%, contrasting with a flat reading in Q4. Meanwhile, fixed investment moderated its decline to 0.1% in Q1, following a sharper 3.4% decrease in Q4. The external sector also contributed negatively to growth. From a supply-side perspective, growth was primarily fueled by the mining sector which is benefitting from higher copper prices and new processing plants.

Looking to the remainder of 2024, we expect economic activity to remain on a strong footing. Private consumption is set to continue as the primary growth engine this year, supported by lower inflation, looser financial conditions, and declining unemployment Additionally, the external sector is expected to strengthen, fueled by increased copper production and higher copper prices. In contrast, government spending is likely to act as a drag on growth. Overall, we believe that the macroeconomic imbalances Chile built up during the pandemic have been largely resolved. After Q1's robust performance, we have revised our GDP growth forecast for 2024 upward to 2.1% from the previous 1.1%. For 2025, we expect a slight moderation to 1.8%.

Mexico: Growth surpasses expectations

The Mexican economy posted better-than-expected Q1 growth versus the previous quarter, even as the annual rate slipped somewhat. Economic activity accelerated slightly to 0.3% in Q1 from 0.2% and beat market expectations of a flat reading. Meanwhile, year-on-year growth slowed markedly to 1.6% in Q1, from the previous quarter’s 2.5% increase. However, this weaker print was largely due to calendar effects.

Domestic demand showed significant acceleration on a quarterly basis, increasing to 1.5% in Q1 from 0.3% in the previous quarter. Private consumption drove this growth, rising by 1.5%, the fastest pace in four quarters. Fixed investment also performed well with a healthy increase of 0.8%. In contrast, government spending growth was more subdued at 0.3%, even with increased spending in certain allocations ahead of June's general elections. However, the external sector negatively impacted growth, as exports remained stable while imports surged by 4.0%. From a supply-side perspective, economic activity was bolstered by a substantial 1.7% increase in the agricultural sector. Similarly, growth in services accelerated to 0.6%, up from 0.3% previously. However, the manufacturing sector experienced a contraction of 0.5%.

While Q1’s reading overshot market expectations, we believe the economy will decelerate to 2.2% this year, down from an exceptional 3.2% in 2023 and further to 1.4% in 2025. Activity should remain robust in Q2 with ongoing expenditure on public infrastructure, a priority for the current administration before their term concludes. However, growth is likely to taper off in the second half of the year due to continued tight monetary policy and moderated growth in the US. Several uncertainties persist, including the outcome of the US presidential elections, the legislative actions of Sheinbaum's supermajority in Congress, and the extent of nearshoring trends in Mexico in the coming quarters.

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

It has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date.

All information in this document is established on data made public by official providers of economic and market statistics. AXA Investment Managers disclaims any and all liability relating to a decision based on or for reliance on this document. All exhibits included in this document, unless stated otherwise, are as of the publication date of this document.

Furthermore, due to the subjective nature of these opinions and analysis, these data, projections, forecasts, anticipations, hypothesis, etc. are not necessary used or followed by AXA IM’s portfolio management teams or its affiliates, who may act based on their own opinions. Any reproduction of this information, in whole or in part is, unless otherwise authorised by AXA IM, prohibited.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ.

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

© AXA Investment Managers 2024. All rights reserved