How green bonds can help foster energy independence

- The geopolitical environment has highlighted the relevance of renewable energy

- While there are challenges with short-term energy provision, countries should see this gas-supply crisis as an opportunity

- Green bonds can be the tool for governments and companies to create cleaner, independent energy supplies

Green bonds are typically thought of as a positive impact investment for the environment, however as recent geopolitical events are demonstrating, the projects they finance also offer countries the opportunity to create energy independence.

Russia’s invasion of Ukraine has resulted in the disruption of the energy markets and accelerated the European Union’s (EU) ambition to reduce its dependence on Russian fossil fuels. At the start of the war, some 40% of Europe’s gas network was supplied by Russia

All of this at a time when reducing emissions to stem the impact of climate change is paramount. While the spiralling energy costs and limited supply are going to have sharp and difficult short-term consequences, this crisis does present governments with an opportunity to carve out energy sovereignty in a sustainable way.

Renewable energy

Increasing the use of smart energy solutions should assist countries in protecting themselves from the geopolitical instability. This can be seen most visibly through the actions of Russia, which controls the main natural gas supply to European countries. However, by moving to cleaner energy, countries are able to off-set this risk; between January and May 2022 in Europe, solar and wind generation, alone, likely avoided fossil fuel imports of at least $50bn

Countries and the private sector need to work to localise production of energy and manage the weaknesses in the global supply chain in order to have access to components and minerals needed for clean energy manufacturing. The nature of green bonds – financing projects that aim to have a positive impact on the environment and have defined outcomes and transparent deliverables – means that already many governments and corporations looking to accelerate their clean energy programme are utilising this option.

It isn’t just about installing more renewable power plants; the grid also needs to be updated so that renewable energy can be distributed to where it is needed. The system is already changing as more houses input energy into the grid through their own solar panels however, the grid also needs to be able to cope with the inconstancy of renewable energy. There is, therefore, a lot of scope for investment in this area and a large portion of green bonds are focussing on this.

Corporations like the Danish energy company Orsted are examples of how a company can use green bonds to finance the transition away from fossil fuels and contribute to upgrading the grid system. Orsted used the finances created through instruments, such as green bonds, to help upgrade its coal-based combined heat and power plants so that they could run on sustainable biomass instead. They also produce batteries to help balance the grid system against the variabilities of wind and solar power.

Another challenge that governments and corporates face due to this sudden gear change in energy focus, is the cost of production. The war in Ukraine, as well as broader global supply issues, has seen the cost of production rise dramatically. However, we believe, it is worth remembering that the costs of renewable power is still much less compared to that of fossil fuels: according to the International Renewable Energy Agency, the lifetime cost per kilowatt hour (kWh) of new solar and wind capacity added in Europe in 2021 will average at least four to six times less than the marginal generating costs of fossil fuels in 2022.

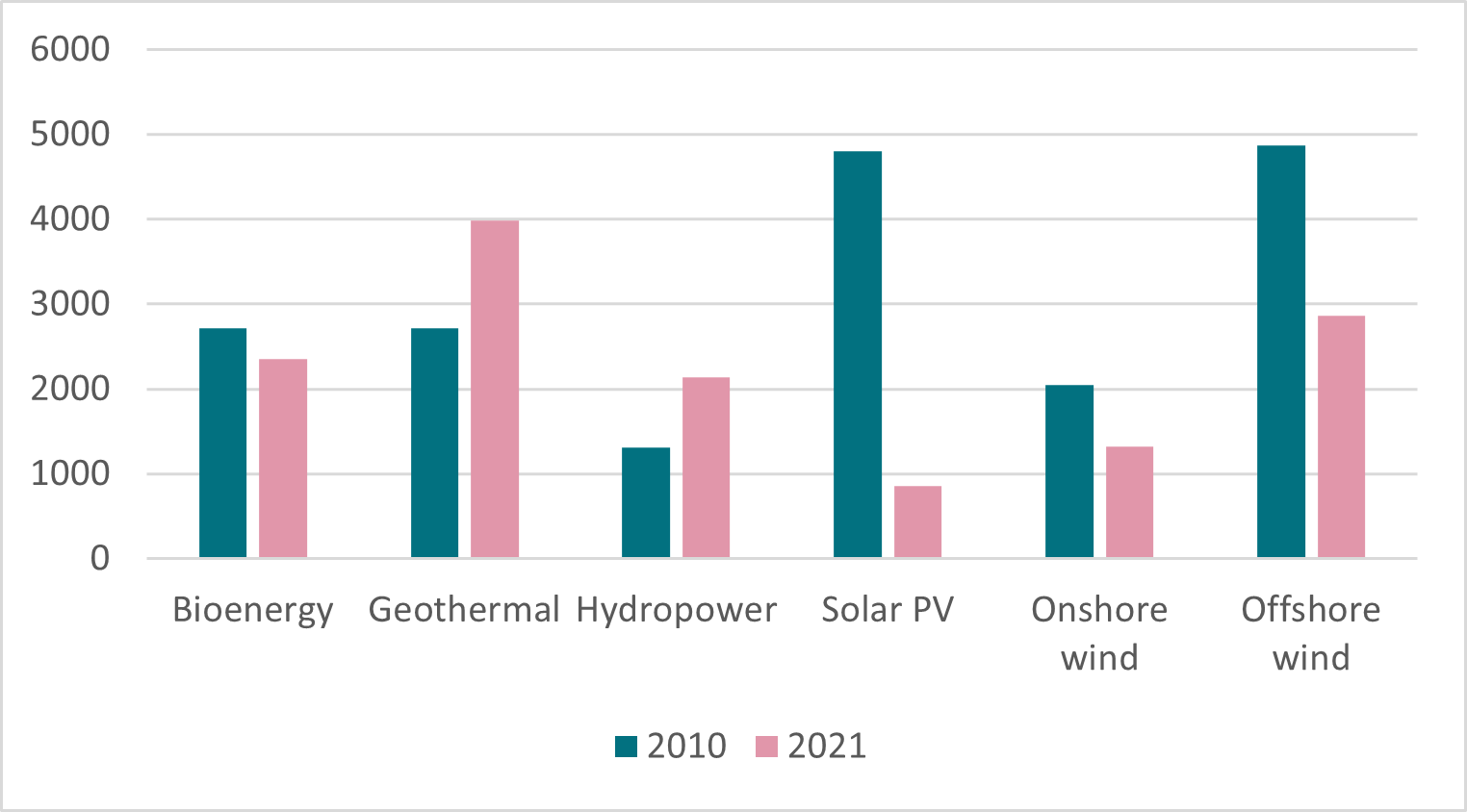

The chart below shows the global weighted average total installed cost in USD/kW in 2010 and 2021:

Source: AXA IM, IRENA as at July 2022

Since 2010, the global weighted average installation cost in USD/kW has fallen for many of the sectors that make up the renewable energy pool; solar photovoltaic (PV) has seen a price drop of 82% and offshore wind’s cost of installation is down 41%

Green Buildings

While access to renewable sources of energy is the most obvious way to enable energy independence for countries that do not have their fossil fuel source, there is also a strong need to reduce the use of fossil fuels in homes and businesses. Green buildings are one solution for this. Not only are they constructed so as not to have fossil fuel-dependent appliances such as gas ovens and boilers, but they are also designed to be energy efficient and reduce overall consumption (and therefore cost) of electricity.

Real estate companies like Covivio are changing how buildings are constructed and renovated by putting sustainability at the core of their business. Their interest in green bond financing ensures that they also provide clearly mapped out long-term targets. This means they offer green bond investors a transparent mix of environmental impacts objectives and forward-looking objectives such as high-level green certification and proactive engagement with tenants.

Using the lessons today for a sustainable and energy independent future

Green bonds provide governments and corporations with a way of financing renewable and clean energy options. The geopolitical environment has shown the challenges of being too reliant on any country or partner for energy provision. By accelerating the transition to renewable energy, governments can help reduce supply risks and reduce the cost of energy. Additional measures of increasing the construction and refurbishment of green buildings can ensure a sustainable and clean infrastructure exists beyond the power plant for households and businesses.

Not all green bonds are the same and it is important to ensure that the issuer’s projects are genuine and will create a positive impact. Those that do are contributing towards a more diversified offering smart energy solutions. This should have the positive impact of not only giving countries greater energy independence but also help phase out fossil fuels and reduce carbon emissions.

Disclaimer

References to companies and sector are for illustrative purposes only and should not be viewed as investment recommendations.

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.