Be invested in better. Invest for sustainable future, now

Overview

Investing for a sustainable future isn’t just a business imperative, it’s a moral imperative too. By backing the companies and projects taking sustainable action now, you can help accelerate the transition to a more sustainable world and a better future for everyone.

At AXA IM, we recognise that we have an active role to play in this transition as a business, an investor and employer.

Climate-aware investing

Our ACT range is designed to enable our clients to take action on global issues such as climate change through their investments.

learn more

Our road to net zero

Our principles for climate action.

The road to a net zero world is challenging to navigate and requires a collective effort. Every individual, company, and government must play its part. There isn’t one single answer or path to solving this challenge, but we want to be one of the leaders on this journey: in our investment choices, the products we offer, the way we engage and vote, and manage our business. We actively invest with purpose and for the greater good, and stand by our convictions while balancing the need to deliver long-term value to clients.

Acting with conviction

We believe that our fiduciary duty goes beyond delivering returns to our clients. It is also about investing responsibly, driving climate action, and ensuring the long-term sustainability of the world we live in. As at 2021, 41% of our eligible Assets Under Management (AUM) are on course to reach net zero by 2050 or sooner, and by 2030, the CO2 footprint of these assets should have decreased by 50% compared to 2019. Our aim is to continue to grow the proportion of net zero aligned AUM in 2022. And as a founding investor of the Net Zero Asset Managers Initiative (NZAMI) launched in December 2020, we are committed to achieve net zero emissions across our portfolios by 2050 or sooner, as well as playing a key role in helping AXA Group realise their ambitious climate goals. As a business, we are working to become a net zero business by 2050, and we are applying a three-step methodology to make this happen: measure, reduce and compensate. We have already committed to reduce our own CO2 emissions by at least 25% by 2025.

Acting bravely and openly

Engagement and dialogue with companies and clients is crucial to influencing the journey to net zero. We recognise that the transition will come with some challenges, and whilst we will allocate more and more capital towards climate solutions and other net zero-aligned assets, we will continue to finance those which we believe are effectively transitioning. We have reinforced our climate engagement and stewardship policy, with a view to divest from climate laggards (a focused list of companies considered material in both portfolios and on climate change) if after three years of constructive engagement not enough progress has been made.

Acting with others

We have always understood that by taking collective action with our peers and pooling our efforts and influence, we have the power to effect tangible change. We will continue to channel more capital towards responsible solutions to our clients, such as our sustainable investing range, as well as offering education programmes on ESG topics for our clients and employees. We believe a global approach to climate action from regulators is essential to ensure success in implementation of sustainable finance and real economy policies, and we are actively involved in steering groups and industry initiatives such as the NZAMI, NZAOA, NZAM and Climate Action 100. At the World Climate Summit recently we asked our industry peers to act decisively with us to influence companies that are not taking climate change seriously, through our decisions on capital allocation.

Vision 2045: AXA IM - A responsible asset manager

We are proud to be part of Vision 2045, a UN-backed campaign that brings together leading companies from around the world to showcase their support for the UN’s Sustainable Development Goals and the core principles of fighting climate change, delivering sustainability and driving diversity and inclusion.

Find out moreInnovations and practices that lie at the heart of our sustainable strategy

We believe as a major global investor, business and employer, we have a role in generating positive and measurable progress for the global economy, the planet and the communities in which we live.

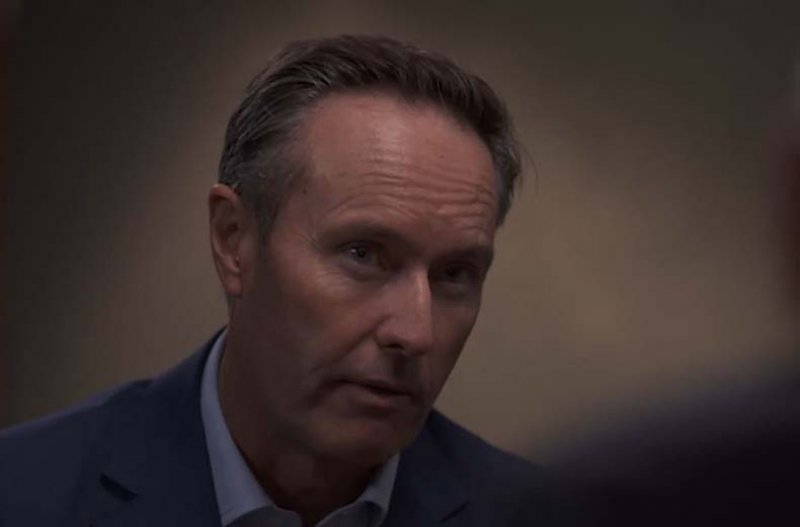

In conversation: 3 experts, 3 perspectives

Decarbonisation is undeniably underway, and the implications are huge for the global economy, our investment teams and of course, our clients. Watch our three experts in conversation as they deep dive into decarbonisation, exploring the macroeconomic landscape and discussing the key challenges and opportunities that arise as we seek to transition to a low carbon economy.

Climate Change – on board? If not, why?

Awareness is growing fast, what do you say to those who still aren’t convinced?

How important is government action in decarbonising our global economy?

Should there be a carbon tax?

What are you seeing in markets as a result of decarbonisation?

New instruments and creating investable opportunities.

Leading the transition as investors

What strategies and policies contribute to our role in leading the transition to a low carbon economy?

What are the issues we face as asset managers with companies greenwashing?

Engagement, dialogue and evolution of climate data.

What do the next generation of investors want to see from asset managers?

Clarity, convergence in regulations and how we can ‘invest for good.’

ESG at the heart of our investment approach

At AXA IM, we believe investing responsibly goes hand-in-hand with our fiduciary duty to clients. Our responsible investment philosophy is grounded in two key principles: we believe it helps us make better investment decisions and can be a means by which we can help accelerate the transition to a more sustainable world.

As a responsible asset manager, we think our conviction-led approach to responsible investing enables us to uncover the best potential investment opportunities across asset classes globally. As well as using ESG data to mitigate risks, we place an emphasis on opportunities.

Investing is about trying to anticipate the future, and we believe that ESG considerations help us do that better. In our view, responsible investing equals better investing. Therefore, responsible investing is fully integrated across our investment processes. We believe RI should be an intrinsic part of investment decisions, not an added extra. As such, accountability for RI should be ingrained across our business and not sit with a separate, centralised team. This is why we have 30+ RI specialists

Our approach towards ESG integration

Watch our videos to find out more about how we integrate ESG at AXA IM.

Our responsible investing approach

We actively invest for the long-term prosperity of our clients and to secure a sustainable future for the planet.

Find out more

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

It has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date.

All information in this document is established on data made public by official providers of economic and market statistics. AXA Investment Managers disclaims any and all liability relating to a decision based on or for reliance on this document. All exhibits included in this document, unless stated otherwise, are as of the publication date of this document.

Furthermore, due to the subjective nature of these opinions and analysis, these data, projections, forecasts, anticipations, hypothesis, etc. are not necessary used or followed by AXA IM’s portfolio management teams or its affiliates, who may act based on their own opinions. Any reproduction of this information, in whole or in part is, unless otherwise authorised by AXA IM, prohibited.

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.