Changing our Climate: active engagement in oil & gas

Overview

As a founding member of the NZAMI (Net Zero Asset Managers Initiative), we have committed to reaching net zero emissions by 2050 or sooner across all assets under management.

As an example of this commitment, at AXA IM, a portion of the assets we managed are allocated to climate solutions and assets aligned with a net zero trajectory while continuing to finance companies that we believe are committed to the transition, which implies:

- Limiting investments in segments of the economy or companies whose business models are not compatible with the transition or that are unwilling to adapt according to us, as defined in our climate risks exclusion policy.

- Investing in selected, credibly transitioning industries and companies, and using engagement with management to encourage them on their journey.

- Backing innovative solutions and future technology alternatives.

- Analysing companies and industries in grey areas to assess their transition potential.

We engage with a number of companies that may contribute to a successful transition to help steer them in this transition journey. This draws in a vast range of businesses, from low-carbon solution suppliers to carbon-heavy resource producers or service providers tackling their own emissions. In order to deliver tangible results, we will spend more time and effort on those with the largest GHG footprints. This logically makes climate change one of the central pillars of our engagement strategy, representing 37% of our total engagement activity in 2023. As a shareholder, we will vote in Annual General Meetings following the same logic: we will support companies genuinely participating in the energy transition, but we will challenge strategies that do not match our climate commitments1.

- More details are available in our annual Stewardship reports as well as Engagement and Corporate Governance & Voting policies: https://www.axa-im.com/who-we-are/stewardship-and-engagement

This approach to the energy transition is the one we apply for the Oil and Gas sector. As part of this we have strengthened our investment policy for the sector in 2022, including new criteria leading to new exclusions on unconventional oil & gas. We engage with a number of companies that remain within the investment perimeter on the basis of clear objectives and a precise schedule.

When engaging with companies, while bearing in mind what our own net zero commitment implies, it is important to understand the specific journey each issuer is in, how they will progressively transition their activities, and the timeframe they are setting themselves in that perspective.

Here we outline how this looks in practice for a selection of four Oil & Gas majors, and how our on-going dialogue with companies has influenced how we voted during their respective AGMs in 2024.

The Investee Companies

- Scope 1 emissions are direct emissions from owned or controlled sources. Scope 2 emissions are indirect emissions from the generation of purchased energy.

- Scope 3 emissions are all indirect emissions (not included in scope 2) that occur in the value chain of the reporting company, including both upstream and downstream emissions.

The Investee Companies

- Scope 1 emissions are direct emissions from owned or controlled sources. Scope 2 emissions are indirect emissions from the generation of purchased energy.

- Scope 3 emissions are all indirect emissions (not included in scope 2) that occur in the value chain of the reporting company, including both upstream and downstream emissions.

Stewardship and Engagement

Our engagement to drive action and create meaningful impact.

Download the report

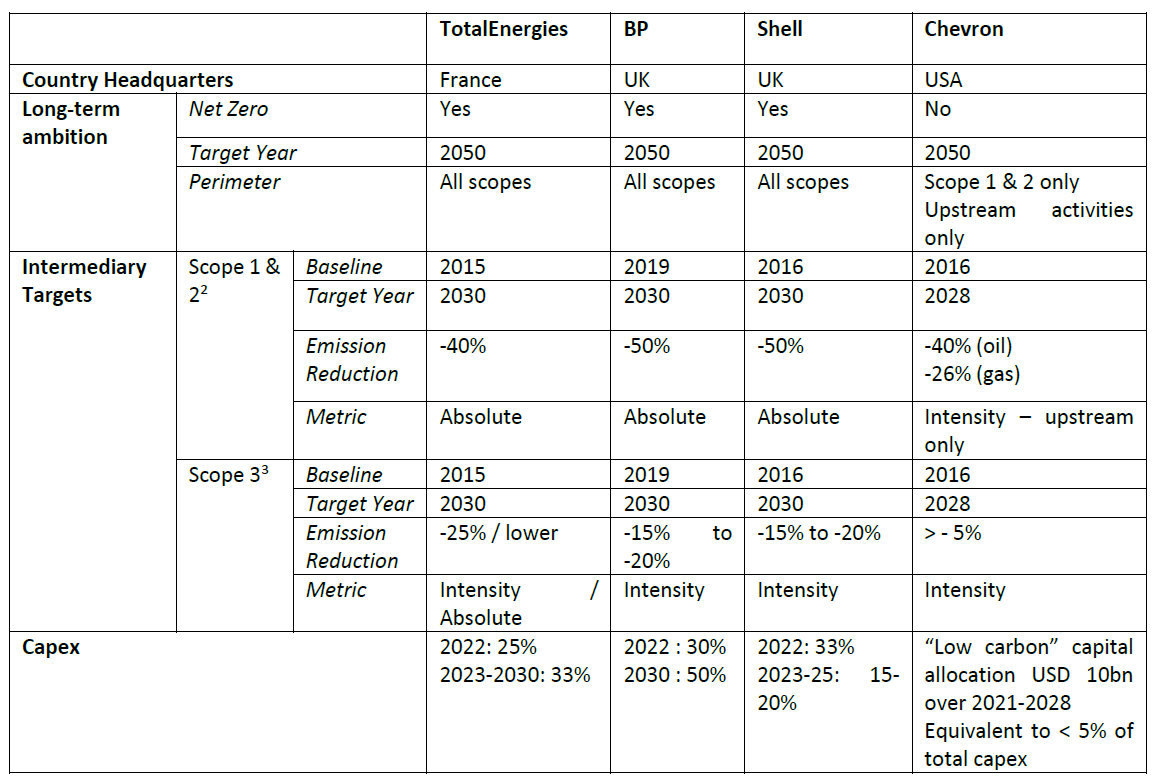

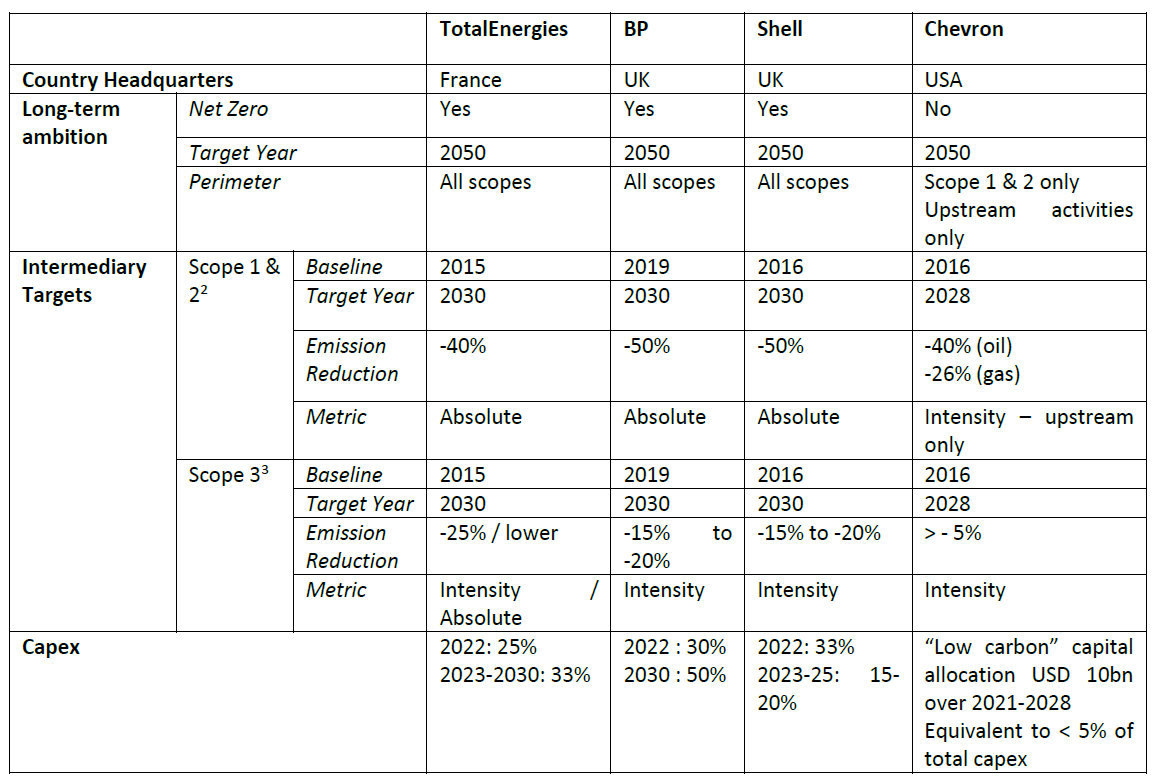

State of Play of their Transition Strategies

In AXA IM view, TotalEnergies’ remains ahead of its peers in terms of commitments and clarity of its transition strategy. Over the past years, the company added new 2025 targets, strengthened its 2030 scope 3 oil target, provided more detailed explanations of how targets will be achieved, and enhanced its scenario analysis and capex disclosure. The company is also progressively improving its disclosure on avoided emissions, beyond LNG sales.

BP announced in September 2020 its intention to shrink its upstream division – largely by disposing of assets – while significantly expanding its renewable energy capacity and increasing the scale of its client-facing units to sell more low-carbon products. This strategy was described as challenging, requiring substantial capital investment in the early years (low-carbon capex was 3% of the total in 2019, 30% in 2022, with a target of 50% by 2030). At the time BP had appear to strengthen its commitment to the energy transition, focusing on transparency, scenario analysis, target setting, and capital allocation.

However, in February 2023, BP communicated it would scale back its plan to cut oil and gas output by 2030 from 40% to 25%, due to a decision to sell fewer assets than initially planned, notably because they had been made more profitable by internal efforts, and also because oil demand is proving more robust than in all transition scenarios.

Shell aims to capitalize on its vast marketing network which allows it to sell three times more energy than it produces, to innovate and deliver low carbon solutions that meet diverse customer needs. The company is set to expand its already dominant position in the LNG market and grow its petrochemical operations, alongside ambitious plans for carbon sequestration. Shell presented this change as “a strategic shift” to focus less on producing electricity, including renewable power, given a profitability described as too low and arguing that a necessary investment in gas was due considering the sustained demand for fossil fuels and to allow for coal displacement.

In March 2024, Shell introduced an updated strategy, reaffirming its commitment to net zero by 2050 but lowering its 2030 Net Carbon Intensity (NCI) target and eliminating the more ambitious 2035 NCI goal. The strategy includes a fresh target to reduce absolute Scope 3 emissions from oil products by 15-20% by 2030. However, this goal is undercut by Shell’s intention to boost LNG production by 20-30% within the same timeframe.

This situation calls for clearer details on how Shell plans to collaborate with consumers to achieve these emission reductions.

Chevron’s energy transition strategy falls short compared to its main European peers. While those peers have committed to achieving net zero by 2050 across their entire activities (including scope 1, 2, and 3 emissions), Chevron’s goal is more limited—it applies only to scope 1 and 2 emissions and focuses solely on its upstream business, excluding downstream operations. The company’s integration of scope 3 emissions into its targets aims to reduce the emission intensity of energy sales, but this target lacks ambition. Chevron does excel in developing low-carbon products like biofuels, hydrogen, and renewable gas, although similar efforts are underway among its peers.

Notably, Chevron stands apart by not planning to enter the renewable electricity business, emphasizing that it does not want to become an electric utility. Despite improvements over the past two years, Chevron still lags behind industry leaders in its energy transition strategy. Meanwhile, while we commend Chevron’s methane strategy, we remain concerned about its reticence in discussing capabilities and contributions to the energy ecosystem. Establishing intermediary targets, aligned with net-zero goals, and addressing the lack of clarity regarding Downstream operations are essential steps.

Influencing Change – Our Stewardship Approach

AXA IM regularly engages with TotalEnergies over the years. In 2023, it held six engagement meetings with the company, all dedicated to climate-related issues. In 2024 so far, AXA IM held another two meetings, ahead of the company’s May AGM, as the company is submitting its Sustainability & Climate Progress Report to an annual vote since 2022.

Beyond regular dialogue, AXA IM also used over the years a set of various tools conferred to us as shareholders to gain maximum engagement effect. Firstly, in 2021, AXA IM worked with Climate Action 100+4 and signed a statement prepared ahead of the AGM that year. In 2022, multiple discussions were held with other investors and stakeholders to call for a legal clarification on shareholder proposals in France. In 2023, we send a formal written question to the company ahead of the company’s AGM to publicly state our support for further transparency on avoided emissions from the sale of LNG as well as other energy sources such as sustainable aviation fuels and biomethane.

For 2024, the company’s AGM was also marked by the mandate renewal of Chairman & CEO Patrick Pouyanné, facing public criticism for certain stakeholders over climate concerns, but also triggering the decision, from a group of shareholders, to file a consultative resolution5 requesting the dissociation of the Chairman & CEO roles, as a way to improve quality of shareholder dialogue around the company’s climate strategy. This was, rightly so, a big focus of our discussions with the company ahead its AGM.

As stated in its Corporate Governance & Voting Policy, AXA IM generally prefer for the roles of Chair & CEO to be dissociated, so that an independent person be leading the supervision of management performance. Yet, a company’s decision to combine the two roles is reviewed based on its own merits, taking into account the checks and balances in place. In TotalEnergies’ case, the discussion mainly revolved around the Lead Director, as well as on the composition of the Board’s Strategy & ESG Committee composition.

In our view, both the profile of the newly-appointed Lead Director (an experienced automotive industry expert and former CEO of a listed company) and its responsibilities enable us to ensure he has the ability to act as a robust counterpower to the Chair & CEO.

Therefore, in addition to our support on the Sustainability & Climate Progress Report, which confirmed the company’s transition strategy (with no scaling back on previously announced objectives), we supported the re-election of Patrick Pouyanné as Chairman & CEO. This does not prevent us to continue our regular dialogue with the company, which will increasingly focus on the company’s narrative around its climate strategy and its role in the energy ecosystem.

More broadly, we are also closely monitoring evolution in the debate, in France and Continental Europe, around the ability for shareholders to file climate-related advisory resolutions, which we see as a credible tool to ensure Board and management accountability to shareholder expectations on climate issues.

AXA IM engaged with BP in climate-related discussions several times during 2023 and 2024. Despite meeting with the Head of Sustainability following their Scope 3-related announcement in February 2023, we were disappointed by the lack of prior consultation ahead of their announcement, leading us to oppose the re-election of the Chairman of the Board at the 2023 AGM. We urge BP to commit to consult shareholders before strategic changes leading to revisions of climate targets, to focus on advancing implementation, and to maintain an active and productive dialogue with us as they prepare for their 2025 energy transition updates.

Our concerns with BP stem from potential “climate-negative” outcome of asset divestitures, where emissions are simply transferred rather than reduced. Therefore, it is crucial for BP to provide further disclosure on asset sales contribute to meeting its emissions targets. We also believe that the remaining years of this decade will see accelerated investment in low-carbon infrastructure, positioning BP strongly to capitalize on these opportunities. We encourage BP to actively demonstrate to the market the value and returns of its transition growth engines.

Consequently, AXA IM co-signed a letter addressed to the Chairman of BP under Climate Action 100+ initiative, requesting no further downward revisions of climate-related targets, clarity on production outlook beyond 2030, no new long lead-time oil and gas projects, responsible divestment of assets, and clarification on the role of offsets in meeting emissions targets. The letter also asked to demonstrate the value from its transition growth engines and how it is supporting customers and policymakers in the transition. In this context, we expect to see peers across the sector in the coming years taking steps to detail the policy, technology, and infrastructure conditions needed to meet climate targets aligned with the Paris Agreement.

Moreover, after the 2024 AGM took place, it has been reported that the company imposed a hiring freeze and may make job cuts in renewables, as part of a decision by BP’s new CEO to slow down investments in big budget, low-carbon projects, particularly in offshore wind. This marks a reversal from the previous CEO’s strategy of moving away from fossil fuels. By contrast, BP has also recently announced a full takeover of two joint-ventures in solar (Lightsource BP) and Sbiofuels (BP Bunge Bioenergia). The new CEO aims for a “pragmatic” approach, balancing decarbonization with meeting near-term fossil fuel demand. Those decisions will be part of our future discussions to ensure that the evolution of the strategy is still aligned with our expectations.

We met several times with Shell over 2023 and 2024 to discuss climate-related issues, as part of 1:1 engagement and collaborative initiatives.

Over the past two years, about 20% of investors have voted against Shell’s Transition report, indicating significant demand for more decisive action and transparency. In light of AXA IM’s Net Zero commitment and the intense scrutiny applied to the financial sector’s dealings with the oil & gas industry, we have raised our concerns ahead of the 2024 AGM. Hence, as a way to further signal our concerns, we have co-filed a shareholder resolution demanding credible mid-term Scope 3 targets, in accordance with our Climate Risks policy. In addition, we have once again opposed the Climate Transition report presented by Shell’s Management for the third consecutive year.

We will continue to engage with Shell, focusing in particular on their Scope 3 targets and how those align with evolutions in their business strategy. We will also aim to discuss lobbying practices, as well as disclosure mechanisms.

As detailed further above, in AXA IM’s view Chevron’s climate strategy lacks ambition compared to its other European peers. Over the years, we have engaged with the company a number of times and have utilized the tools at our disposal, including our voting rights, to express our concerns. Our actions include supporting a climate-related shareholder proposal in 2021 and opposing the re-election of directors on the public policy and sustainability committee in 2022. Additionally, we co-filed a shareholder proposal in 2023 related to Chevron’s scope 3 emissions and publicly disclose our intention to oppose certain directors ahead of the 2023 AGM. Given the company’s unwillingness to adopt a robust climate path, which reflects a lack of Board oversight, we have decided to vote against all directors up for re-election, and publicly pre-disclosed our votes ahead of the 2024 AGM. As part of our ongoing engagement with the company, we also communicated directly to them our votes and their rationale.

- Climate Action 100+ is an investor-led initiative to ensure the world’s largest corporate greenhouse gas emitters take appropriate action on climate change in order to mitigate financial risk and to maximize the long-term value of assets.

- Inclusion of the resolution in the AGM agenda was blocked from the Board of Directors (such decision being ultimately confirmed by the Nanterre Commercial Court).

Learning and Next Steps

2024 AGM agenda and results continue to reflect inconsistencies when it comes to the oil industry’s response and responsibility to climate change, but also shareholder stances on them.

Although we consider Chevron to be a laggard both in terms of strategy and governance (the company is the only one from our sample that never requested shareholders’ approval on its climate strategy), the company did not face the same amount of public scrutiny. Indeed, not a single “pro climate” shareholder proposal made it to the company’s 2024 final AGM agenda, and all management resolutions were approved with a vast majority.

Similarly, Shell recorded more or less equivalent results on both management and shareholder climate-related resolutions, despite having backtracked on several of its initial climate-related objectives. On the contrary, TotalEnergies recorded a substantially decreased support level on its Sustainability & Climate Progress Report, from 89% to slightly below 80%.

The stark reality of climate change highlights the urgent need for economies to transition to a different energy ecosystem, weaning us off fossil fuels. We are committed to supporting the energy transition in all its dimensions, embracing its complexity, discarding simplistic solutions, thinking long term, and acting now. This means thinking in terms of entire value chains, whether they relate to supply or to demand, but also calling for government action to help accelerate an orderly transition to a more sustainable world. This urgency was acknowledged with the COP 28 commitment to progressively transition away from fossil fuels.

Protecting shareholders’ rights

Beyond climate change and engagement with oil and gas companies in our portfolio, we are also particularly mindful of any potential developments which may impact our basic shareholder rights.

In January 2024, ExxonMobil initiated legal proceedings against the proponents of a climate-related proposal filed ahead of the company’s 2024 AGM, seeking to exclude such proposal its AGM ballot and challenging the role of the Securities and Exchange Commission (SEC) in overseeing shareholder resolutions.

This legal battle is a watershed moment, raising questions about shareholder ability to file shareholder proposals in the future, thus potentially weakening the mechanism for holding corporations accountable and hence impacting engagement effectiveness.

Therefore, we signed a public statement, together with 38 other investors, supporting the SEC’s role as the preferred arbiter of shareholder proposals.

Previous years' engagement

Disclaimer

Companies shown are for illustrative purposes only. It does not constitute investment research or financial analysis relating to transactions in financial instruments, nor does it constitute an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.