Macro outlook– Twin Policy Test

Key points

- We confront our forecasts from last year for 2023: we were too pessimistic on the impact of the monetary tightening on growth, at least in the US

- We expect a still wide transatlantic gap in 2024. The Euro area will need to deal with the beginning of fiscal consolidation coming on top of the lagged effect of monetary tightening

- Higher long-term interest rates are a challenge. Even the US will have to adjust its public finances to a sounder footing, although it’s very unlikely to start in 2024

2023 Post-mortem exercise

At the same time last year, we wrote that 2023 would be the year the twin inflationary shock of the post-Covid reopening and the Ukraine war would start to fade at the cost of a significant tightening in financial conditions and an economic slowdown. We were only half right.

True, inflation has started to decline convincingly, and this goes beyond the mechanical effect of the fall in energy prices from the dizzy heights of 2022. The deceleration in core prices in both the US and the Euro area has been facilitated by the normalisation of global supply lines. The difficulties China is encountering with protecting demand from the side effects of the real estate correction are fuelling a return to deflation which supports the moderation of manufactured goods prices at the global level. There is still “way to go” to return inflation to the central banks’ objective, but there is enough disinflation in the pipeline to consider that both the Fed and the ECB have reached a peak in their tightening in Q3 at roughly twice what used to be seen as the neutral rate in their respective constituencies.

We were however too pessimistic on the impact the monetary tightening would have on the real economy, at least in the US. We thought that the exhaustion of the fiscal push combined with the adverse effect of still high inflation on purchasing power and the erosion of the savings accumulated during Covid would make the economy particularly vulnerable to the rise in interest rates. What we missed was the fact that the current monetary tightening is very unusual in the sense that it does not follow a phase of rapid leveraging in the private sector. There is no sudden “refinancing cliff” which would force corporations into an emergency deleveraging, compressing spending. With a still financially comfortable corporate sector, employment managed to remain resilient. Job creation has fallen below its pre-Covid trend since the end of spring, but is still positive enough, combined with decelerating but robust wages, to support income growth in excess of headline inflation.

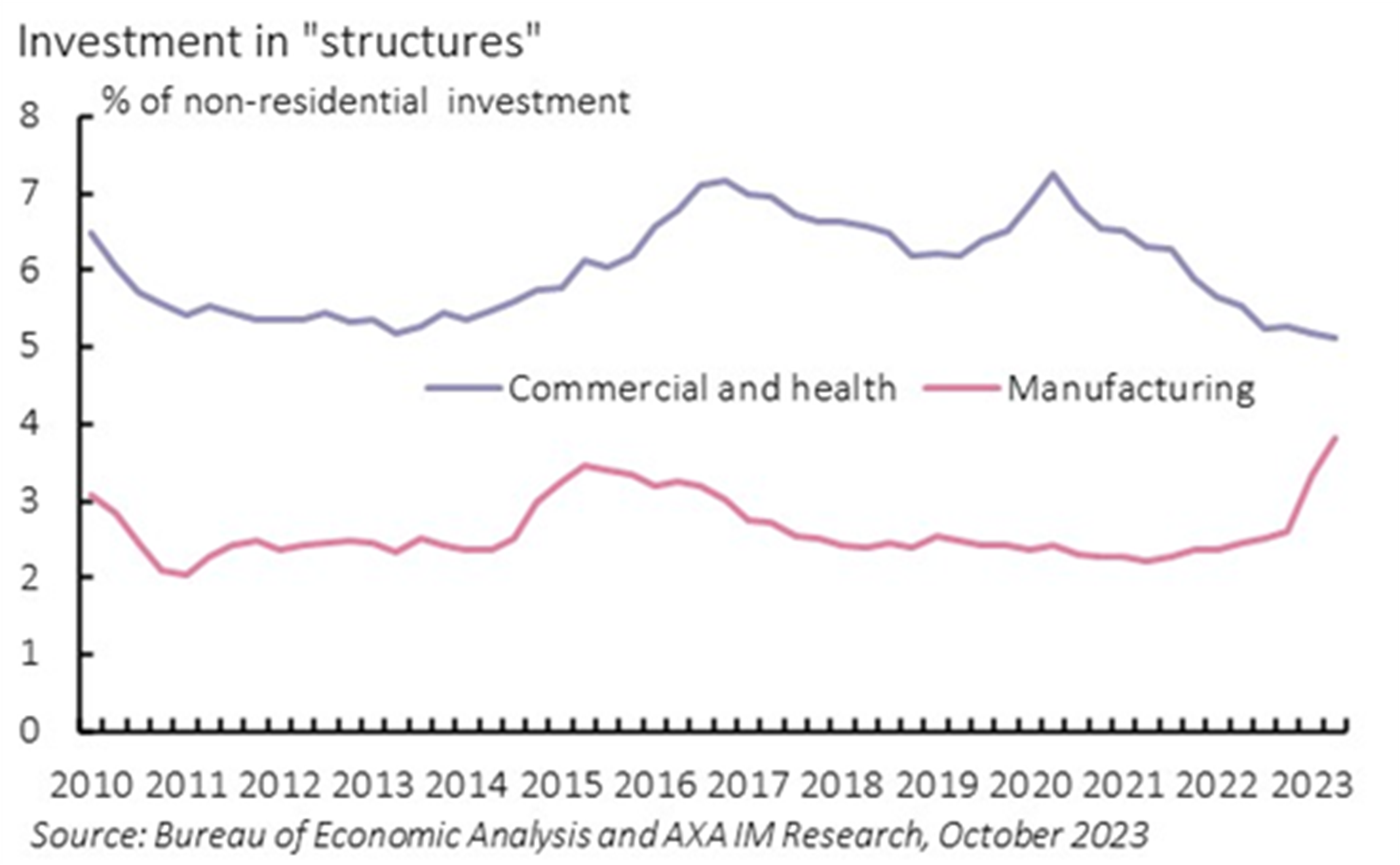

Exhibit 1: The IRA’s impact is already tangible

Unfortunately, the Euro area did not fare as well and has been flirting with recession since the beginning of the year. The specific vulnerability to energy prices continued to fuel weakness in industrial output, especially in Germany, but softness has extended to countries such as France and Italy which had been quite resilient at the peak of the energy shock. There may be more than just the differing sensitivities to gas prices at work. The US economy is visibly responding fast to the Inflation Reduction Act (IRA), with in particular a steep rebound in manufacturing capex (Exhibit 1), while the EU’s own decarbonation support programmes don’t seem to move the dial for now. In a nutshell, while in the US a new form of fiscal push continues to offset much of the monetary tightening, the Euro area benefits from less protection from the usual effect of higher policy rates, now fully transmitted by the banking sector.

Transatlantic gap still wide in 2024

2024 would not see any amendment to these diverging transatlantic patterns. Even if we expect both the Fed and the ECB to start cutting rates around the same time in mid-2024, the impact of the accumulated monetary tightening will probably still reach its peak in the second half of the year. In the Euro area, this adverse effect on aggregate demand will be compounded by the austerity turn of fiscal policy, already visible in the budget bills for 2024 voted or in the legislative process in the member states. Governments are proceeding cautiously – they learned from their mistakes when they endeavoured to cut deficits too harshly after the Great Financial Crisis – but still, the “fiscal stance” – the change in the cyclically-adjusted balance – will turn restrictive next year. The Euro area’s paradox remains that its biggest member state, with the highest capacity for spill-over across the entire monetary union and one of the widest fiscal spaces given its low public debt, remains reluctant to use its firepower to mitigate its current and structural weakness. Meanwhile, as an election year, 2024 is very unlikely to bring about any fiscal austerity in the US.

The balance of risk is also more clearly tilted to the downside in Europe than in the US. Indeed, the tragic situation in the Middle East is a major source of uncertainty for next year. So far, the crisis has not had any tangible impact on oil markets. In case of escalation though, for instance through a direct involvement of Iran, oil prices moving significantly above USD100/barrel would become very plausible. The direct impact on GDP would be similar across the Atlantic (although the US has become a net exporter of oil, consumers there would still be hit) but the exchange rate ramifications would put the ECB in a very delicate position. Indeed, elevated oil prices are now consistent with a strong dollar, which would magnify the impact on European inflation, making it more difficult to accommodate the shock.

Navigating higher long-term rates

A rise in long-term interest rates now disconnected from expectations on the monetary policy trajectory has been a striking development of the second half of 2023. While ascertaining the causes of this move is difficult in real time beyond the obvious effect of Quantitative Tightening, we would highlight the new-found difficulties for the US Treasury to attract sufficient demand at its auctions as a sign that the continuous rise in supply of new paper, fuelled by the US unwillingness and/or readiness to curb the fiscal deficit, is exceeding traditional investors’ appetite for long-term financial assets.

While we expect some additional correction from the 5% peak in US 10-year yields seen in October 2023, some of the forces behind the rise are likely to remain. Irrespective of the causes of the rise in long-term yields, this should in any case call for prudence from policymakers. In his Op-ed to our outlook, Olivier Blanchard (WAITING FOR OLIVIER’S PUBLICATION WEBPAGE URL LINK), while maintaining his view that advanced economies can sustain a higher debt ratio, calls for credible fiscal consolidation plans to be put forward. In the US, it is fair to say that they are completely missing.

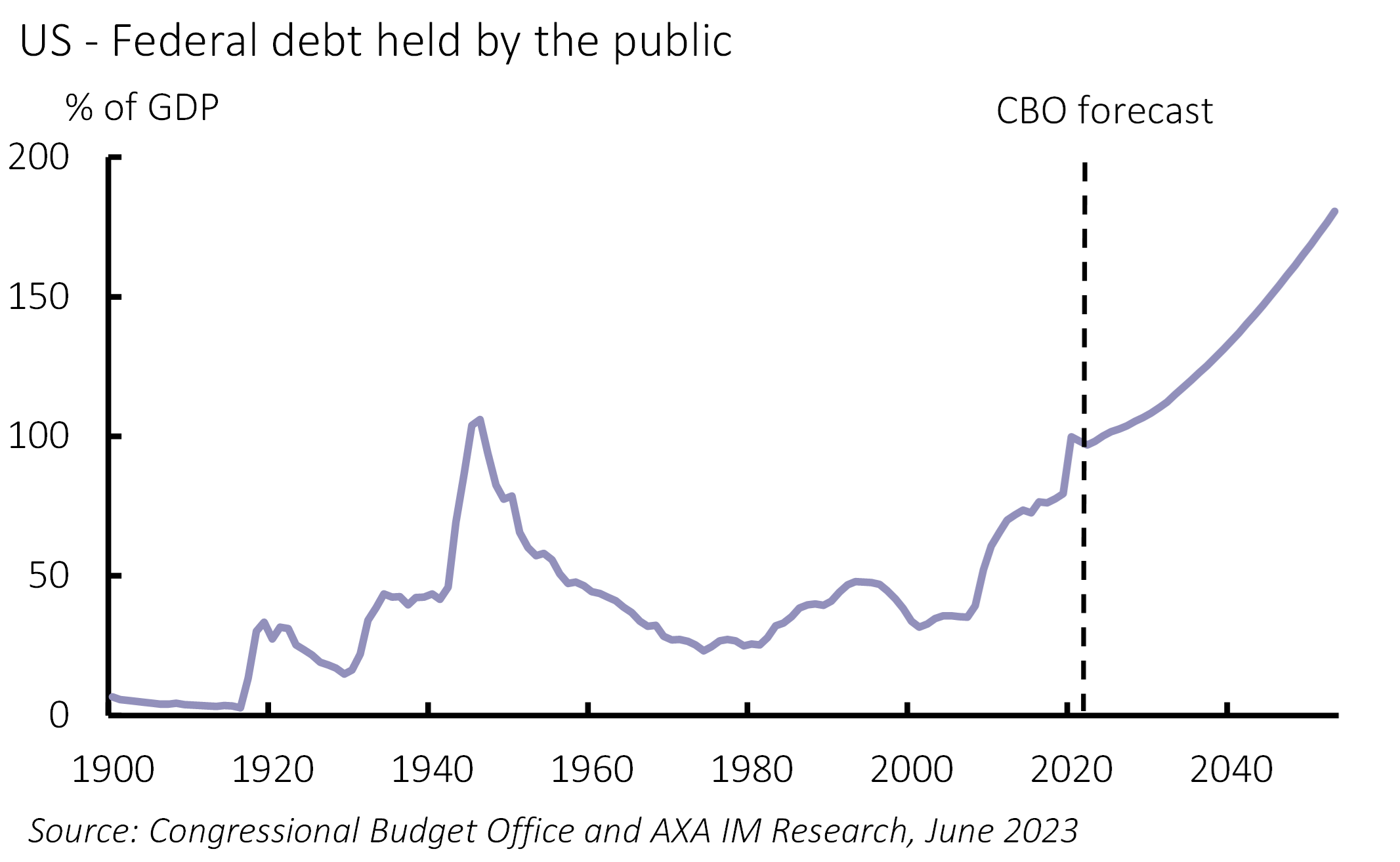

The Inflation Reduction Act came out without any caps to the tax credits. On the Republican side, a victory of Donald Trump next year would probably mean that the nominally time-limited tax cuts he granted in his first mandate would be prolonged. The US fundamental fiscal issue is that its welfare state is gradually providing a “European” level of social protection to a growing proportion of its population without the matching tax receipts. The Congressional Budget Office’s long-term trajectory for public debt is quite scary (Exhibit 2). Given the extremely polarized state of US politics, finding the necessary bi-partisan resolve to address these issues is daunting.

Exhibit 2: Scary trajectory

No such institutional paralysis can be found in Europe, and despite the region’s acute demographic challenges, there is a politically realistic pathway towards a stabilisation of public debt there. The issue in Europe is more the absence of room for manoeuvre. The episode of spread widening in Italy in September 2023 is a reminder that, even though there are arguably fewer fundamental reasons why long-term interest rates should rise than in the US, European governments are walking a tightrope. If an adverse risk to growth materialises, there won’t be much dry powder left.

In a nutshell, the US and the Euro area will have to pass two different policy tests in 2024. The US needs to demonstrate it can “push the envelope” a bit further and maintain an accommodative fiscal stance without triggering too much pressure on yields. The Euro area needs to demonstrate it can go through a joint monetary and fiscal tightening without too much damage to growth, political stability and without adding to financial fragmentation.

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

It has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date.

All information in this document is established on data made public by official providers of economic and market statistics. AXA Investment Managers disclaims any and all liability relating to a decision based on or for reliance on this document. All exhibits included in this document, unless stated otherwise, are as of the publication date of this document.

Furthermore, due to the subjective nature of these opinions and analysis, these data, projections, forecasts, anticipations, hypothesis, etc. are not necessary used or followed by AXA IM’s portfolio management teams or its affiliates, who may act based on their own opinions. Any reproduction of this information, in whole or in part is, unless otherwise authorised by AXA IM, prohibited.

Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent.