Insurance investment outlook 2024: Catching opportunities across the risk spectrum

Key points

- The global economy is expected to slow down, while inflation and financial conditions are expected to ease further - but the pace and impact on leveraged assets remain uncertain, with risks to the upside

- With all-in yields at multi-year highs, we see potential opportunity for insurers to secure future investment earnings while remaining prudent and managing risks

- Insurers should be prepared to catch potential additional investment opportunities further across the risk spectrum when they arise

Central banks further tightened monetary policies across the board in 2023 in a bid to curb inflationary pressures, with the US Federal Funds Rate increasing by 100 basis points (bp) and the European Central Bank hiking its deposit rate by 150bp – significant increases which have had a notable impact for insurance investors.

However, surprisingly for most market participants - including policymakers - is the stronger than expected resilience of the US economy. GDP growth came in at a 5.2% annualised pace in the third quarter (Q3) and we expect above trend growth of 2.3% overall in 2023.

A soft landing is now the central scenario, defying the predictive power of certain recessionary signals – first and foremost, the largest cumulative increase in official interest rates in decades.

It is likely the influence of much tighter monetary policy has been offset by a significant fiscal expansion and greater than expected investment, but most importantly, by stronger than anticipated consumption as the US economy continues to benefit from the remaining excess savings accumulated during the pandemic.

The lowest-rated segments of the credit and equity markets reacted sharply to what proved to be a non-systemic US regional banking crisis in March, as well as to tighter financial conditions later in the year. Credit spreads - the difference in yield between corporate and government bonds of the same maturity - have since come back close to their long-term averages but we still think they are trading on the tight side given the slower growth outlook.

Consumer resilience and improving investments have reduced the risk of a US hard landing, but tighter financial conditions, a slower real disposal income growth, the exhaustion of excess savings, and a softer consumption should translate into a slowdown going forwards.

Softer inflation provides some comfort on the execution of a soft-landing plan, but inflation remains well above target levels and is still threatened by tight labour markets and consumer resilience even if it is somewhat reduced. Inflation persistence is still a risk and while the market could be (again) seduced by a dovish pivot, we see inflation rates converging to targets only progressively during 2024.

Europe’s outlook is weaker; inflation has been decelerating as well but supply factors (energy prices, supply chain disruption, hiring difficulty and low productivity) continue to constrain growth and put pressure on prices. This supports a stagflation scenario, and we cannot rule out recession by year-end, though it is not our central expectation.

Milder inflation and slower economic activity mean policy rates have likely peaked but uncertainty and risks on the upside keep central banks in a prudent stance and support the case of interest rates to stay high for linger, although we are closer to a widely expected easing phase.

Higher for longer and the curve dynamics

Financial conditions have tightened further as long-term yields rose after the summer. Both macro and technical factors are at play. The US’s economic resilience and the growing consensus around a soft landing have implications for rate expectations.

Increased investment spending and demand for capital have also raised perceptions that the neutral rate has risen, as rising investment should support productivity gains and growth potential, further boosting longer-term rates.

More than a decade of quantitative easing has suppressed the risk premia on fixed income assets. The continuation of quantitative tightening should cause the opposite effect and contribute to maintaining longer-term rates higher, especially in a context where governments are issuing more debt to finance increasing deficits and where supply absorption should rely more on markets.

We have seen weak demand in a recent 30-year Treasury auction which sent yields spiking for long-duration government bonds, demonstrating the market might be worried about large and increasing deficits and Treasury supply.

Figure 1: 10-year interest rate volatility – US, Germany, UK

Source: AXA IM/Citi Velocity – 7 November 2023

Despite an economy in stagnation, longer-term yields have also risen in Europe by contagion. Longer-term interest rates are pricing both economic resilience and uncertainty and react swiftly to data flows. Further softening in inflation should see longer-term yields ease over the coming quarters but not only should they remain at an elevated level, but they are also likely to remain volatile for some time (Figure 1).

All-in yields (not spreads) at multi-year highs

Market participants have been surprised by the resilience of the US economy given the most aggressive tightening of financial conditions in decades and the same holds true for risky assets. It is hard to not be tempted by the current level of yields which are now at their highest levels since the 2008-2009 financial crisis, but spreads are close to long term averages and on the tight side given the weaker outlook.

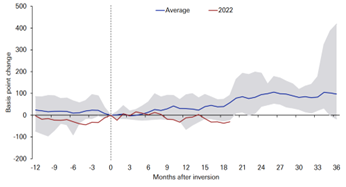

Though past performance does not guarantee future returns, history suggests a high probability of increasing default rates and spread widening in tightening cycles and following curves’ inversions (Figure 2).

Figure 2: Changes in US BBB spreads in tightening cycles since 1955

Source: DB - Is the recession running late? November 2023, Moody’s, FRED, Bloomberg LP

Investment grade corporates’ fundamentals remain generally solid. Many have been able to restore their balance sheets during the post-pandemic recovery and to navigate the inflationary environment, but the monetary tightening is being passed through. There is evidence of some deterioration in fundamentals. Profit margins have started to decline due to higher labour costs and financial costs, albeit from an elevated level.

There is not much to refinance at this stage in the investment grade space as corporates had the chance to lock in cheap financing before the turning point, but interest coverage ratios deteriorate and we expect this weakening trend to continue, given the ‘higher for longer’ backdrop and deteriorating earnings.

Unsurprisingly, the high yield segment is the most sensitive to tighter financial conditions. Ratings agency Moody’s reported that global default rates on riskier debt had already reached 4.5% over the year to September, above the historical average of 4.1%.1

Default outlooks do not look that dramatic when considering base case scenarios with lower or mild economic growth, decelerating inflation, and easing financial conditions, but a more extended period of more subdued demand and elevated financing costs could put more businesses into trouble.

European high yield spreads look relatively more expensive given the weaker economic backdrop and the most leveraged issuers already show significant signs of stress. The current spread differential between euro high yield and investment grade markets is much tighter than what it was during previous periods of financial tightening and there is some room for decompression. In our central ‘soft’ scenario we anticipate digestible defaults and spread widening, but we remain cognisant that there is still a high degree of uncertainty on the outlook and this suggests a high potential for more volatility.

Investment grade corporates generally have sound balance sheets, and the maturity wall is not front-loaded but investment grade spreads are not immune to bouts of volatility that could arise from stress in the lower rated market segments. Credit selectivity and diversification remain key to manage drawdown and volatility risks.

- Can corporate America cope with its vast debt pile?" Financial Times, 6 November 2023

Implications for insurance companies

Higher rates and yields are not without any risks for insurers, but if these risks are properly managed, yields at multi-year highs represent a tremendous potential opportunity for the industry.

We see three main areas for insurance companies to consider: decelerating but still high inflation; higher for longer – albeit more volatile – but expected to ease interest rates; and liquidity risk.

Decelerating but still high inflation

Higher inflation can hurt insurers’ profitability and ultimately their capital position. Life insurers are less sensitive to the inflation risk as they usually have commitments expressed in nominal terms. Non-life insurers are the most sensitive to inflation risk. Not only do higher realised costs of claims impact their profitability but the increase in the expected cost of claims leads to an increase of technical provisions and to a deterioration of their capital position.

The impact on future profits partly depends on the ability of insurers to increase premiums. The European Insurance and Occupational Pensions Authority (EIOPA) reported that Eurozone non-life insurers’ expenses and claims respectively increased by 4.3% and 11.3% in Q4 2022 compared to Q4 2021 while premiums only increased by 6.4% with a combined ratio reaching a high level of 99.9% in Q4 2022.2A slowdown of the economy combined with persistent inflation could limit insurers’ ability to push through premium increases.

Given the uncertainty on the future market dynamics and path of inflation, we believe non-life insurers should seize the opportunity to maximize and secure their future investment earnings to compensate the potential drag on the liability side.

Interest rates: Higher for longer, more volatile but expected to ease

An increase in the long-term rates can have a positive effect on life insurers’ capital positions, especially for those with a large negative duration gap as the valuation of liabilities is more negatively impacted than the valuation of lower duration fixed income assets.

The situation can differ significantly between insurers, but EIOPA reports that as of Q4 2022 the median weighted average modified duration for fixed income portfolios of European Economic Area (EEA) life insurers was 5.7 years whereas the median modified duration of the technical provisions of EEA life insurers was 9.5 years.3

The same report indicates that technical provisions of life insurers decreased by 23% from Q4 2021 to Q4 2022 mainly due to the increase in interest rates and that the assets over liability ratio reached 109.2% as of Q4 2022 - showing that on average liabilities declined more than assets. The tightening of long-term yields experienced in 2023 is likely to have had further positive impacts on life insurers’ capital positions.

For reasons mentioned earlier, long-term rates are likely to remain volatile and better entry points could still be seen but given the expectations for easing yields in the coming quarters, life insurers should not count on this positive effect again in the foreseeable future. Rather, they should pay attention to the impact of a reversal. Life insurers who still have a negative duration gap should take advantage of current yields at multi-year highs to work on closing their duration gap.

Lengthening assets’ duration is not always straightforward even when bond markets offer the appropriate instruments to do so (this is not the case in every capital market). The surge in interest rates over recent months has produced significant stocks of unrealised losses which prevent insurers from operating major portfolio rotations without hitting their bottom line.

Insurers can use written premiums and reinvest bond redemptions to extend their duration, but they can also use interest rate derivatives i.e. a financial contract, the value of which is based on some underlying interest rate or interest-bearing asset.

Derivatives offer other advantages too. In a context where interest rates are expected to remain volatile along the curve, large swings in interest rates can disturb the asset liability matching and require more agility. By combining bond investing and derivatives an insurer can gain in flexibility in managing its duration and convexity gap.

The combination also allows to better distinguish between interest rate and credit risk factors, which in turn provides more leeway to optimise the risk-return profile of the credit exposure as it is consequently less constrained by liability-matching objectives.

Evidently, yields at multi-year highs for core fixed income assets is a unique occasion for insurers to rebuild book yields and secure future investment earnings, especially as they might struggle to maintain their technical margins. An economic slowdown, lower corporate profit margins and real disposal income could make it difficult to compensate persistent inflation with higher premiums.

In this context the contribution of investment earnings to the bottom line is paramount. As yields are expected to ease at some point, this is all about managing reinvestment risk.

Reinvesting cash-flows and rotating portfolios into longer-dated fixed income assets is one way to hedge but here again derivatives can help when portfolio turnover is constrained.

Forward starting swaps or bonds can allow locking in future reinvestment yields. Swapping floating rates into fixed is another tool in the box. With current levels of yields and the prospect of lower rates in the medium term, it might be tempting to lock in returns beyond what would be just required by liabilities i.e., becoming slightly long duration on a net basis.

Securing future investment returns is not only a question of profitability and competitiveness, but it also contributes to mitigating liquidity risk, something that is clearly still on the radar.

Liquidity risk on the radar

The UK pension crisis in autumn 2022 and the US regional banks crisis in spring 2023 are the kind of events that remind us of the importance of matching liquidity needs. Multiple factors can contribute to impacting the liquidity position of insurers.

The first such factor is higher rates along the yield curve. The value of liquid assets has been much more negatively impacted by increasing rates over the last few years compared to illiquid or alternatives assets whose valuations’ adjustment usually lags. This has reshuffled asset allocations and reduced buffers of liquidity and eligible collateral. EIOPA reports that the liquid asset ratio of EEA insurers declined sharply in 2022 and rates are higher today than they were at the end of last year. Higher rates also potentially mean more incentives for policyholders to lapse on their existing contracts to reallocate into higher-return saving solutions.

Higher costs of living can also push certain consumers to surrender, to complement their disposal income. Lapse risk is topical in certain markets and regulators have it under scrutiny. The combination of higher lapse rates, lower liquidity buffers and stocks of unrealised losses can be painful.

Insurers could implement liquidity risk management solutions including schemes allowing to refinance available assets at a reasonable cost. They should also take advantage of current high levels of yields in the public fixed income markets to restore liquidity buffers. Delivering competitive investment returns to policyholders can also make a difference. This is challenging as it can take time for the average book yield to catch up with market rates but lagging too much can amplify lapses.

Inflation on a standalone basis can also reduce liquidity if it is not properly priced into new premiums as higher paid claims deteriorate technical cashflows. Here again, securing higher investment returns can mitigate this burden.

Using derivatives can bring a lot of value as they notably provide more flexibility in managing liability matching, optimising and hedging (foreign) credit exposure, hedging reinvestment risk as well as mitigating lapse risk. But derivatives also represent another source of liquidity risk. European insurers primarily use receiver interest rate swaps for liability matching purposes as well as currency hedging instruments to hedge their non-domestic investments. EIOPA reported in its 2022 financial stability report that insurers had to liquidate some assets to pay margin calls in the first half of 2022 and rising rates since then might have impacted liquidity positions further. In another report released in October EIOPA details the results of a sensitivity analysis based on EEA insurers’ derivatives positions as of the end of 2022.5

It shows that a 100bp parallel upward shift of the yield curve generates significant liquidity needs but that on average insurers hold enough liquidity assets. But the situation is not homogenous, and a cash shortfall occurs for 19% of the 160 insurers in the sample, suggesting the need to potentially sell assets at a very inconvenient time.

In the same report EIOPA highlights the interest of setting up liquidity facilities as a tool to optimise liquidity management and mitigate liquidity risk. Insurers should also make sure they hold sufficient eligible collateral in the portfolios where they hold derivatives and use high-grade securities rather than cash as collateral when possible.

- Impact of inflation on the insurance sector, EIOPA, 5 October 2023

- Impact of inflation on the insurance sector, EIOPA, 5 October 2023

- Impact of inflation on the insurance sector, EIOPA, 5 October 2023

Fine-tuning the fixed income investment roadmap

In this context we recommend taking a phased approach while bringing an element of sophistication in the management of insurance fixed income solutions.

In phase one, we prefer to stay on the safe side given the uncertainty on the economic outlook and to focus on rebuilding book yields and managing duration and reinvestment risks. The biggest part of yields is the risk-free rate currently and long-duration high-grade assets offer a decent investment income, well above average book yields.

Combining bond investing and interest rate swaps can free some capacity to also exploit multi-year-high yields in the investment-grade credit space while remaining defensive and shorter in credit duration.

As always in the credit space we advocate for both selectivity and diversification outside the domestic market to mitigate volatility and drawdown risks. Forward swaps – another type of derivative - or forward bonds are potentially useful to hedge reinvestment risk and secure future investment earnings and the beauty is they can be structured in a way that is less painful from an accounting standpoint. As discussed earlier setting up a robust liquidity and collateral management framework is key.

Phase two is contingent upon less uncertainty or risks materialising with wider spreads across the credit universe, potentially using credit derivatives or active fixed income exchange-traded funds (ETFs) to increase credit beta exposure and capture volatility spikes.

In the riskier market segments, i.e., high yield and emerging market debt, we continue to prefer actively managed short duration strategies which exhibit higher returns on capital, lower volatility and drawdown risks and a better liquidity profile. We are probably not there yet but better to get prepared to catch opportunities across the risk spectrum.

Accelerate the shift of the business mix

Insurers have been pushing less capital-intensive saving products over the last decade to reduce the burden of guarantees while consumers have been also looking for higher investment returns in a low rates environment. In 2021, total life insurance gross written premiums increased by 14.1% across the EEA.5

This growth was mostly driven by index-linked and unit-linked insurance which reported a 34.8% increase.6 EIOPA reports that the number of new contracts dropped in 2022, presumably due to inflationary pressures and lower real disposal income, but the proportion of new contracts continues to be significantly higher for unit-link types of products compared to traditional insurance policies.7

Insurers are working hard on developing innovative solutions to capture this growth potential. Among those, we find sustainable thematic investing, sustainable active ETFs or products providing an access to illiquid and alternative assets.

Higher interest rates and yields also provide a unique opportunity to broaden the range of products and to offer higher investment returns with a reasonable level of risk, notably compared to pure equities whose risk premium has significantly diminished. Target maturity fixed income funds or structured products are rebecoming appealing saving solutions in the current higher rates environment.

As always there is no shortage of issues for investors to consider – economic slowdown but still high inflation and interest rates, ongoing geopolitical tensions and of course November’s US Presidential Election.

But for now, the backdrop is about economic recalibration; we don’t expect an end-of-cycle crash, but a mid-cycle easing. We believe this will ultimately put 2025 in position for reacceleration, but before that, the coming months represent a tremendous window of opportunity for insurers in the fixed income space.

- Consumer Trends Report 2022, EIOPA, 11 January 2023

- Consumer Trends Report 2022, EIOPA, 11 January 2023

- Impact of inflation on the insurance sector, EIOPA, 5 October 2023

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales, No: 01431068. Registered Office: 22 Bishopsgate, London, EC2N 4BQ.

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

Image source: Getty Images

© 2023 AXA Investment Managers. All rights reserved