Outlook Summary – Slowing mid-cycle, not crashing end-cycle

Key points

- Following 2023’s resilience, we expect global growth to slow in 2024 – this should be a mid-cycle adjustment, not an end-of-cycle collapse. 2025 should enjoy acceleration

- Central banks are likely to ease policy in the face of further disinflation but most will manage restrictive policy rather than add fresh accommodation

- 2024 will be a big year for elections. Globally the US Presidential race will likely be the most consequential

Uncertain ground

The outlook for 2024 and 2025 is built on end-of-2023 uncertainties – albeit less than there were at the start of 2020, as the world was plunged into the pandemic. Geopolitical uncertainties mirror those at the end of 2021, ahead of Russia’s invasion of Ukraine as the Middle East crisis poses a major risk to the global economy. An escalation of the conflict risks a marked impact on oil prices, regional activity and global sentiment. However, it is not obvious that escalation is the most likely path, with the US and others supporting Israel, but cautioning its actions, alongside more divergent interests across the Arabian Peninsula restraining reactionary forces.

Beyond geopolitics, there is uncertainty around the global economy’s cyclical position. This is exemplified in the US, where expectations of recession have faded. Recent economic convulsions have not been cyclical: the pandemic was an exogenous shock that forced a deep recession, resulting in supply constraint and demand-stoking policy responses. The resultant inflation was not the product of an overheating, end-of-cycle economy. Uncertainty still surrounds the degree of quasi-permanent structural change that economies have seen – as well as the balance of central bank tightening versus pent-up demand. The assessment we make is whether the economy faces an end, or mid-cycle, adjustment.

Recessions no longer central forecast

For Western economies we envisage mid-cycle adjustments. For the US, we had expected the degree of tightening from the Federal Reserve (Fed) to result in a dip in output and mild recession. But consumer resilience has delivered a slowdown by instalments. We now expect the US to enter the broadest phase of its slowdown with consumer spending forecast to ease from robust growth over the summer. This should see it slow to a below-potential pace of 1.1% in 2024, before the economy rebounds above trend by end-2025 – we forecast expansion of 1.6%. We no longer forecast outright recession. With an associated modest loosening in the labour market, inflation should reach the Fed’s mandate in 2025 but end the year modestly higher. This suggests limited room for renewed Fed accommodation. We envisage modest rate cuts (three this year, two next) but characterise these as moderating restrictiveness as opposed to outright easing.

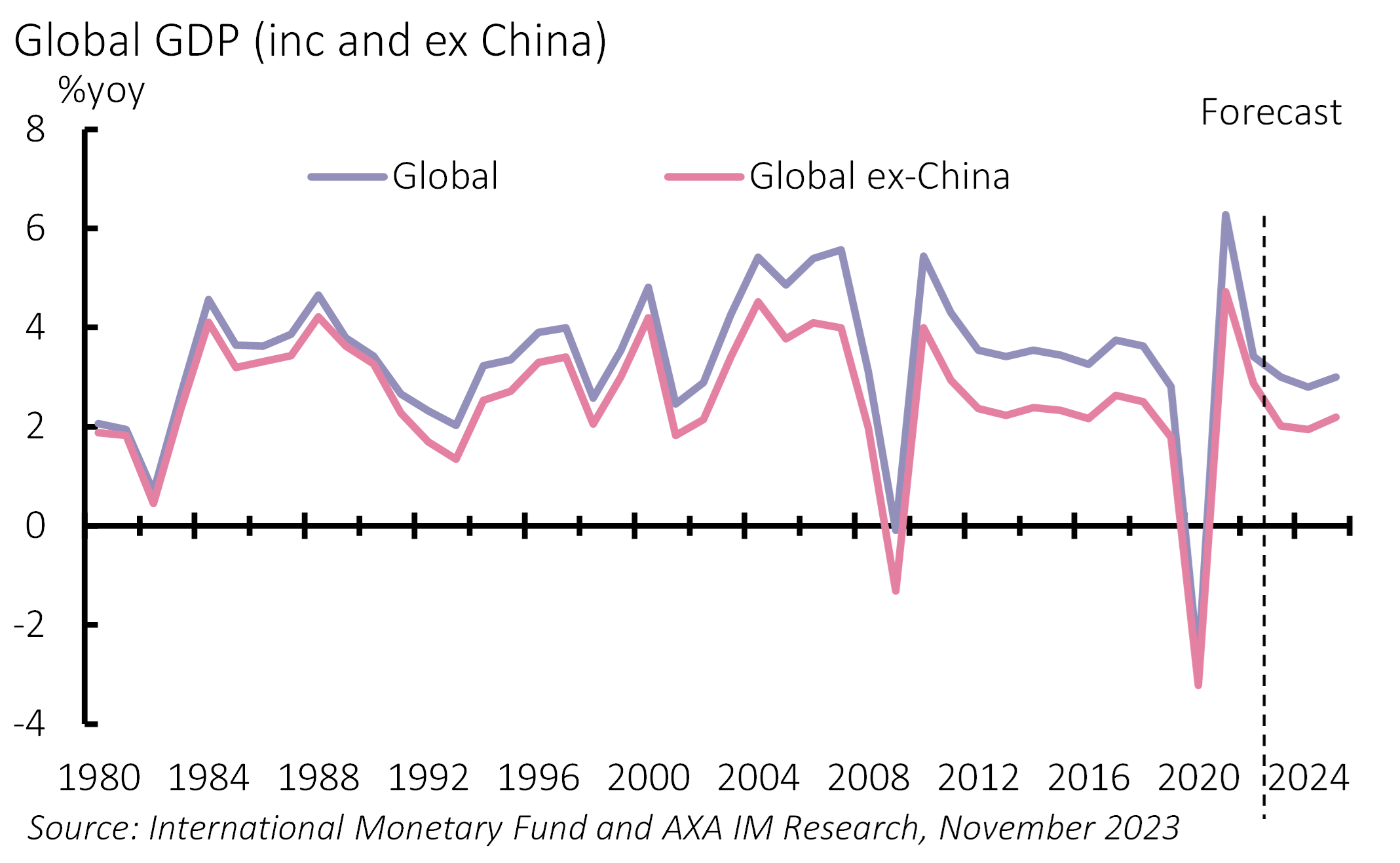

Exhibit 1: Global growth expected to soften in 2024

European economies are facing a tougher test. Ongoing supply constraints continue to impact Eurozone economies. Solid wage growth and limited easing in labour markets should see firmer real disposable income growth as inflation falls over the next 18 months. This should mitigate risks of outright contraction, despite the weak investment backdrop. We forecast Eurozone GDP growth of 0.5% this year and just 0.3% next – weaker than consensus – before rising to 0.8% in 2025. However, even this subdued outlook is unlikely to drive inflation sharply lower as weak supply growth should limit the emergence of spare capacity. We see inflation back to target around mid-2025 and the ECB easing monetary policy, but more cautiously than markets envisage, forecasting the first cut only from June 2024, ending 2024 at 3.25% and 2025 at 2.75%.

The UK will likely face a weaker outlook. We forecast growth of 0.5% this year, 0.0% in 2024 and 0.5% in 2025 and are very wary of the lagged impact of Bank of England (BoE) monetary tightening – even though policy now appears to have peaked – with delayed mortgage resets likely to tighten monetary conditions across 2024. Our central forecast is for the UK to be on the cusp of recession; risks are skewed to contraction. Concerns of wage stickiness will likely see the BoE on hold until H2 2024, but then we think the lagged pass through of policy stimulus will require exaggerated stimulus. We forecast rates closing next year at 4.5% and 2025 at 3.75%.

Beyond cyclical dynamics

Firm action from Chinese authorities looks set to deliver China’s 2023 growth target of “around 5%” – we forecast 5.2%. Stimulus should quicken the quarterly growth pace next year, even if this equates to lower annual growth of 4.5%, before slowing in 2025 to 4.2%. We expect further stimulus if growth falters. The economy’s reliance on fiscal/infrastructure boosts is delivering an unbalanced economy and increasing resource misallocation with implications for China’s longer-term growth outlook. The longer-term remedy would be structural, market-led reforms. Yet this appears to run contrary to President Xi Jinping’s appetite for control. This creates a long-term risk for China. We do not expect this to come to fruition over the next two years, but it will hang over the longer-term outlook.

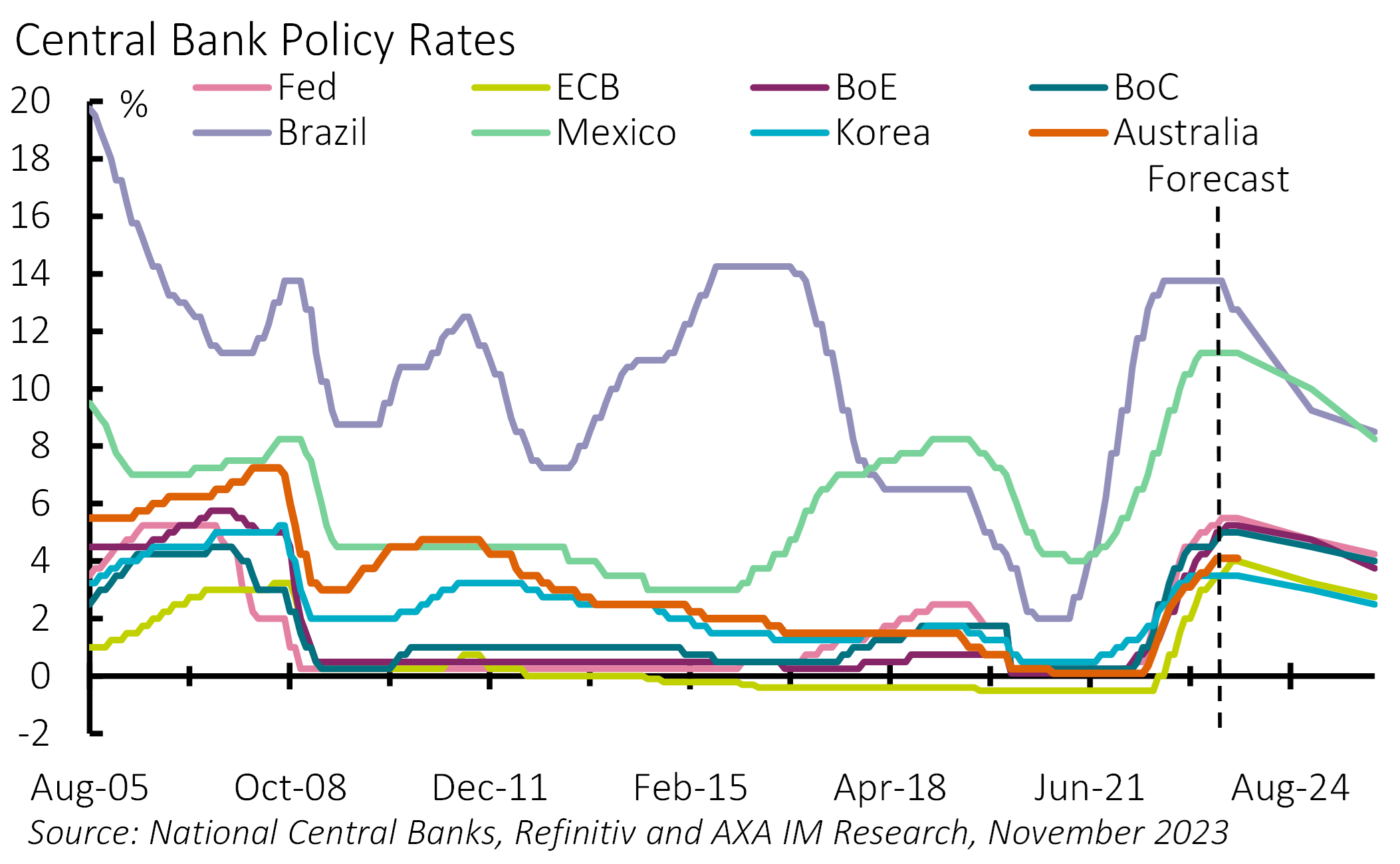

Exhibit 2: Central banks should (further) loosen policy

Japan faces longer-term change with inflation above the Bank of Japan’s (BoJ) 2% inflation target after decades of battling deflation. The BoJ has all but dismantled its yield curve control but has been cautious of further accommodation withdrawal. It is monitoring wage developments to determine its next move. Early signs suggest solid (positive real) wage growth next year. We expect the BoJ to remove its negative interest rate policy around spring and forecast a modest tightening thereafter. Yet after decades of around zero rates, the economy is vulnerable to rate adjustments. Fiscal and financial stability risks should see the BoJ raise rates only gently to 0.25% by end-2025.

Structurally stronger emerging markets

Emerging markets (EM) proved more resilient in growth terms across 2023, even as inflation fell broadly in line with expectations (though core rates remained stickier) allowing many EM central banks to ease policy. This should continue, although softer global growth and tight financial conditions are likely to prove headwinds next year. Inflation is likely to fall further, although disinflation should be driven more by core adjustments. Central banks have adopted a more cautious tone and this is likely to prevail: we expect rate cuts in 2024, but broadly consistent with stabilising real rates.

Our outlook suggests global growth slows to 2.8% in 2024, softer than the 3.0% in 2023, before accelerating to 3.0% in 2025 with most economies avoiding recession (Exhibit 1). This mid-cycle adjustment should see central bank policy rates falling – but forecast to stay at or above neutral in most regions (Exhibit 2). This has been likened to the mid-1990s US soft landing. But this is an uncomfortable comparison for EM economies, a period remembered for systemic EM crises, including Mexico (1994), Asia (1997) and Russia (1998). While conditions are set to remain tight, we note significant structural improvement since, including institutional credibility; anchored inflation expectations; floating exchange rates; better capitalised banks; and no excess capital inflows lately. Exceptions remain and tight conditions will see stresses for some but we are less concerned about the risk of a systemic shock in EM.

A protracted period of elevated rates raises average financing costs: for households, corporates and sovereigns, suggesting elevated vulnerability. Fiscally, we will monitor Italian sovereign risks – a country with elevated debt, high sovereign yields and one that has recently pushed back its plan to meet a sub-3% of GDP deficit by 2026. France has also pushed its expectation back to 2027. We also focus on the US. The latest official deficit forecasts average nearly 6% over the rest of this decade. With debt forecast at 98% for 2023, this is sustainable for now. But with debt projected to exceed 110% by 2030, markets will question future sustainability at some point.

The Trump card

Next year will be a key year for politics. More than two billion people will go to the polls, admittedly, most by virtue of India’s elections in April/May. EMs will collectively hold 19 elections in 2024 – we will pay close attention to those in Taiwan (January), South Africa (May-August) and Mexico (June). However, the most significant election for EM – and the world – is likely to be the US Presidential Election. While we are not certain it will be a re-run of the 2020’s Joe Biden-Donald Trump race, that still looks likeliest at this stage. A return of President Trump would have domestic implications in terms of adjustment to fiscal policy. However, globally its potential impact on geopolitical events poses the most uncertainty – a return to trade wars as well as questions over support for Ukraine and Israel. European elections (May) and UK elections (likely October) should also have important local impacts.

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.